Children’s clothes are growing. Little wonder, the $24.01 Bn market for kidswear in India is expected to grow 2.63% every year, driving the volume to 16.9 Bn pieces by 2029.

So, don’t blink when you see toddlers and teens trotting as fast as adults in the world of fashion. And, you are sure to lose count if you try to list the brands in vogue.

From Gini & Jony to NapChief, Hopscotch, Ed-a-Mamma, Lilliput, Little Kangaroos, Mothercare, Baby Forest, United Colours of Benetton – the list seems endless as demand soars on the back of the growing influence of social media on parenting choices and rising disposable income.

There is indeed no longer a gap between kids, their older siblings and their parents when it comes to dressing à la mode. In the $2.4 Tn consumer market of India, that’s well on course to be the world’s second largest at $4.3 Tn by 2030, D2C brands have become a rage – some offering unique propositions, some doing a copy-paste, and others simply following the West.

What stands out in this rush is responsible fashion. “We combine sustainability with affordability. Our bamboo-based, plant-friendly clothing appeals to parents who want safe, eco-friendly options for their children without spending too much,” Swapnil Srivastav.

His Kidbea claims to offer 100% clean, chemical-free products made using eco-friendly materials like bamboo fibre, cotton, linen, and muslin. “We create certified organic, spill-proof, anti-bacterial, breathable, and ultra-soft products for children, designed not just for comfort, but to support relaxed parenting.”

Kidbea also sells soft toys, feeding bottles, nibblers, and other accessories, with a consistent emphasis on non-toxic, sustainable materials.

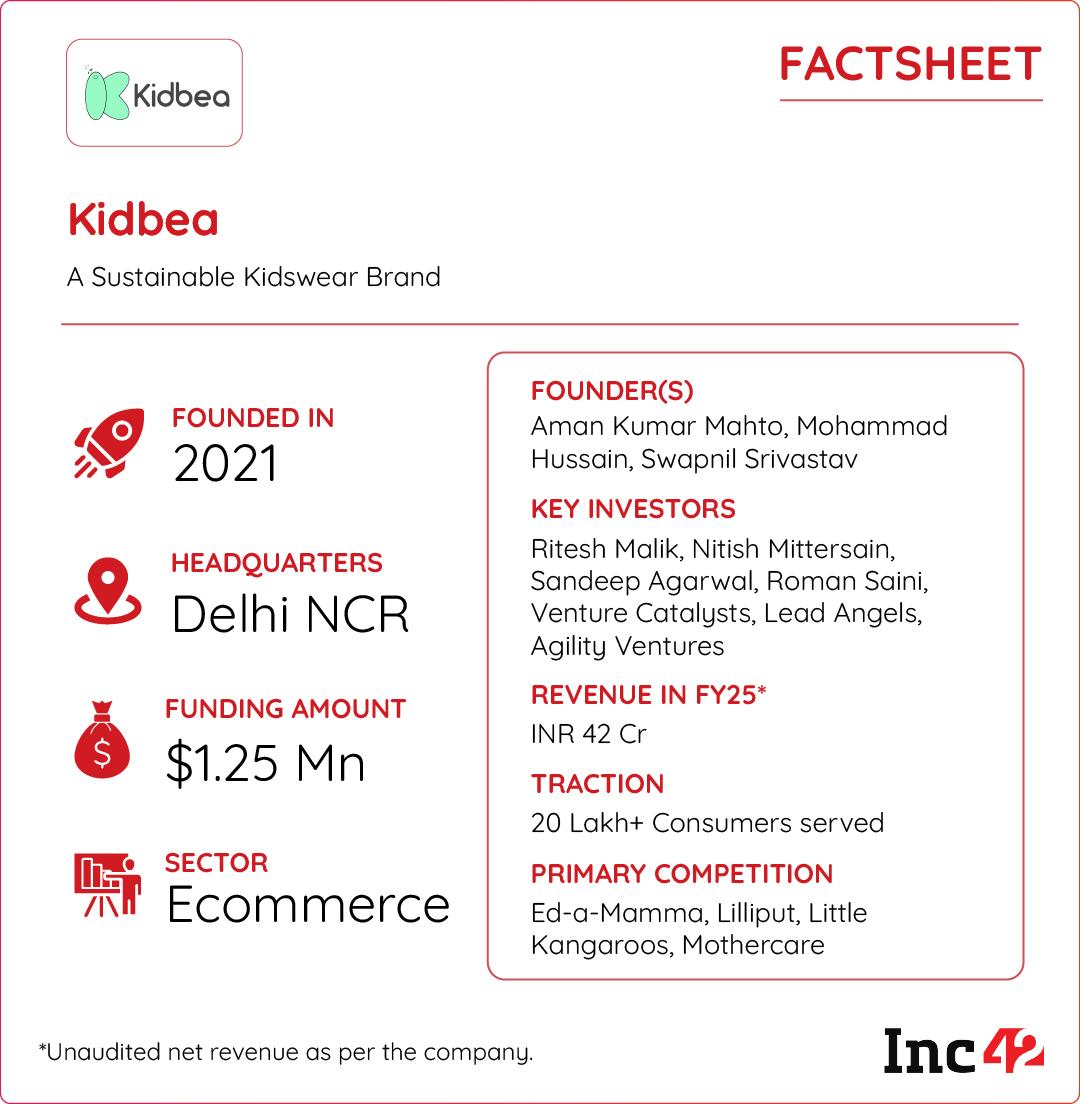

In the four years since Aman Kumar Mahto, Mohammad Hussain, and Swapnil Srivastav rolled it out, Kidbea has raised over $1.25 Mn and now looks at a larger round this year. The startup is backed by prominent investors like Ritesh Malik (Innov8), Nitish Mittersain (Nazara Technologies), Dr Shriram Nene, Sandeep Agarwal (Droom), Roman Saini (Unacademy), besides institutions like Venture Catalysts, Lead Angels, and Agility Ventures, and notable angels such as Japanese actor Hiro Mizushima and the UAE textile chairman.

From Smart Shirts To Kidswear…Fashion has always been a stronger driving force for the three computer science students. Entrepreneurship was another common factor that bound the three in their college days when they started supplying printed tees, coffee mugs and such merchandise at college fests.

The small, self-registered brand, Diceywear, mopped up INR 15 Lakh by the time they graduated. “It felt like freedom, we had the seeds of confidence germinated in our mind, and we had the first taste of business success,” Srivastava recounted.

They found their true calling in the apparel space, while their expertise was in technology. “We blended the two – passion and profession – and came up with Smart Shirt.” These shirts, fitted with a GPS chip, became more relevant with India still licking the wounds inflicted by the Nirbhaya incident that had rocked the entire nation.

“Our product allowed women to share their live location in emergencies just by tapping the fabric, without needing any internet connectivity,” Srivastav said.

The trio registered the product under the brand name Smartzwear. They believed it would be a game-changer, but the reality had it other ways. There was no taker for their idea. With the funds tap running dry, they tried to reach out to 50 investors, including the likes of Sequoia, Elevation Capital, and Matrix.

Forty-nine rejections later, they found the last ray of hope. Although the investor refused to park his money, he showed them the way. “This investor was a parent himself and had been relying on international brands for his newborn’s clothing, but due to COVID, he had to switch to Indian brands. That’s when his baby started developing rashes and skin irritation from the harsh chemicals used in fabrics.”

This became the turning point for the founders. The trio began exploring the kidswear market and Kidbea came up with 200 SKUs in the next two months.

… Then They Bent It Like BambooLaunching those 200 products and starting up in an unknown market threw up a host of challenges. “It was very difficult to first figure out the right manufacturers and then convince them to manufacture for us,” said the founder.

The idea was clear – creating a 100% chemical-free kidswear brand – but the journey began only after their first trip to India’s textile hub of Tiruppur in Tamil Nadu. While exploring the raw materials there, they found bamboo-based fabrics incredibly soft, chemical-free, antibacterial, and naturally anti-odour. They decided to learn the entire process from the ground up – how bamboo fibre is converted into yarn, then into threads, and finally into fabric, which is then stitched into clothing.

“Since we were targeting toddlers up to two years, comfort and stretch were crucial. Most brands used pure cotton with no elasticity, which didn’t work for babies who are always moving. We saw that gap and hired a textile engineer to ensure that our fabric was both soft and stretchable,” he said.

After resolving the initial challenges, the founders shipped the fabric composition to Noida and partnered with a Delhi-based exporter who helped turn their chemicals-free fabrics into finished garments. He had worked with international brands and came on board as an early investor in 2022.

The brand has, according to Srivastav, never wanted to set up its own manufacturing unit because owning and managing such a large facility would not only be cost-intensive, but also a major operational challenge.

Kidbea has tied up with 8–10 dedicated manufacturing partners bound by exclusive MoUs to maintain confidentiality in designs and compositions. The partner units are in Tripura, Ludhiana, Bhilwara, Noida, and Delhi. Kidbea also runs a 10,000 Sq Ft warehouse in Delhi NCR, where all packaging and supply chain operations are managed.

While bamboo remained at the core for its breathable and antibacterial qualities in sustainable clothing, Kidbea went on expanding its material palette. The brand also uses organic cotton (free from synthetic pesticides), muslin (for humid seasons), linen and even recyclable polyester in some categories. “Sustainability is maintained to the smallest of elements – threads, buttons, and prints – using organic dyes and keeping them free from any chemical paints or coatings,” said the founder.

… And Came The Growth PlaybookKidbea’s manufacturing units are certified by the Global Organic Textile Standard (GOTS) and the Forest Stewardship Council (FSC).

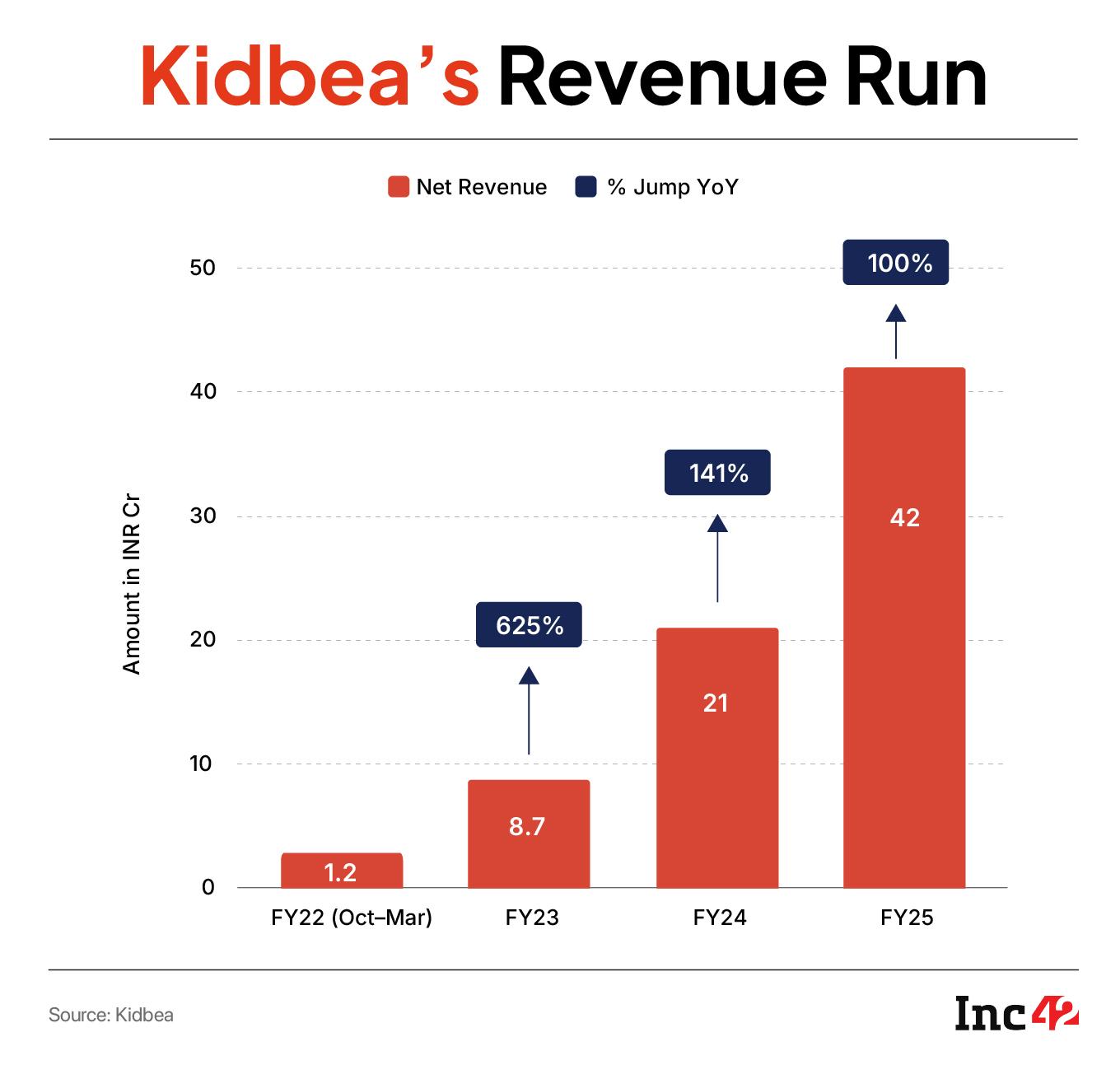

The startup doubled its net revenue to INR 42 Cr in FY25 and also claimed to have turned profitable with a net of INR 35 Lakh and an EBITDA margin of 2.5%. This was achieved despite significant investments in marketing and retail branding, where nearly 30–32% of its revenue was spent.

According to the founders, Kidbea posted INR 7.4 Cr in revenue in Q1 of FY25, while it reached INR 13 Cr a year on, reflecting a growth of over 75%. In March alone, the revenue reached INR 6 Cr, giving the brand the confidence to target a topline of over INR 80–100 Cr in FY26, along with a projected net profit of INR 5 Cr.

According to the founders, several key learnings have played a role in shaping the brand’s growth journey so far. One of the first insights was that positioning the brand as a premium kidswear label wasn’t viable in India, where the luxury market for children is still quite small. Parents were hesitant to spend INR 1,500–2,000 on a romper that their child would outgrow in a few months.

Another learning was around consumer preferences. While Indian parents earlier preferred bright, bold colours, there’s now a clear shift towards western aesthetics like pastels, nudes, and minimal, European-style designs. Recognising this change helped the brand align better with modern parenting trends.

To address pricing and scalability challenges, the founders brought on board their Delhi-based exporter as an investor, who pumped in INR 35 Lakh and gave them full access to his manufacturing unit. This partnership helped Kidbea bring the cost of the same romper down to INR 500 without compromising on quality. Though the investor later exited operations, he retained 5–6% stake and played a key role in enabling affordable, scalable production, the founder said.

Kidbea finds a mix of large players and emerging startups in the fray for consumer attention as the $1.31 Bn green fashion market in India averages a growth rate of over 10% between 2023 and 2028 to reach a market size of INR 25,000 Cr (around $3.01 Bn) by FY30. One of the most dominant forces in the space is FirstCry, which functions as a marketplace but heavily prioritises its own private-label brands such as Babyhug and cutewalk.

In the D2C space, Kidbea faces direct competition from players like NapChief, Hopscotch, Baby Forest and Earthy Tweens. One of its key competitors in terms of USP and product portfolio is Ed-a-Mamma, which was acquired by Reliance and has crossed the INR 150 Cr revenue mark.

From daily wear for kids aged 0-6 years, Kidbea is gearing up to serve children in the 6-10-year age group. It plans to launch an exclusive ethnic and partywear collection in collaboration with a Kolkata-based brand. “This new range will be slightly premium, with prices going up to INR 10,000. We’re trying to bring sustainability and comfort to partywear, and this will be announced soon,” Srivastav said.

The brand is on course to roll out its first two EBOs with an expected revenue of INR 30–35 Lakh each.

Besides its own website, Kidbea sells its products on marketplaces such as Myntra, Amazon, FirstCry. It is also available across more than 200 retail touchpoints, primarily through multi-brand outlets (MBOs) and partnerships with Shoppers Stop. Additionally, it has partnered with Digital Handlooms for regions such as Rajasthan and Gujarat, with products available in 15 stores. A small volume is shipped to the UAE, Australia, and Bahrain.

“Offline channels contribute 60% of our total sales and online the remaining 40%. We are aiming to balance it equally in the near future.”

Despite this strong growth rate, managing the supply chain and inventory remains the biggest challenge for the brand. The brand maintains INR 8–10 Cr of inventory in its warehouse to meet the soaring demand; however, they remain concerned about a supply shortage in future. Kidbea has hired supply chain experts to build a tech-enabled, AI-driven software designed to forecast seasonal demand, identify best-selling SKUs, and enable smarter inventory planning.

Apoorva Ranjan Sharma, the cofounder and managing director of Venture Catalysts, painted a picture of possibilities for the brand. “With India’s daily birth rate exceeding 67,000 children, there is a substantial opportunity for Kidbea to target the market across both metropolitan areas and small towns, driven by the increasing awareness among new parents regarding sustainable and eco-friendly clothing. Kidbea’s innovative approach and dedication to quality align with the changing expectations of mindful consumers,” he was quoted as saying in the media.

[Edited by Kumar Chatterjee]

The post Inside Kidbea’s Sustainable Spin On India’s $24 Bn Kidswear Market appeared first on Inc42 Media.

You may also like

Detentions, protests & identity: Bengal's poll battle heats up

Bihar SIR: SC says no interim stay on draft electoral roll, asks EC to accept Aadhaar, voter ID

Rajnath Singh replied in Parliament on Operation Sindoor!

“Rohit Averaged 10 & Virat 30”, Manjrekar Feels Their Retirement Didn't Affect Team Much

Chelsea agree huge transfer for Joao Felix with FIVE more players set to follow