After a two-year gap, IPO-bound boAt returned to profitability in FY25. The consumer electronics giant’s comeback was driven less by soaring sales and more by strict cost control and disciplined expense management.

Here is a look at how the company fared in FY25:

- boAt clocked a net profit of INR 60.4 Cr against a loss of INR 73.7 Cr in FY24

- Operating revenue rose a marginal 1% YoY to INR 3,073.3 Cr

- Total expenses fell 6% YoY to INR 3,040.4 Cr

- Procurement costs declined by 9% YoY to INR 2,069.8 Cr

Audio Wins, Wearables Spiral: A deeper look into boAt’s revenue streams reveals a company at a crossroads. While its core audio business remained robust and continued to grow, its wearables vertical showed signs of faltering, witnessing the second consecutive year of revenue decline in FY25.

Pent-Up Global Demand: While the home turf dominated with INR 3,050.5 Cr in sales, international revenue surged 44% YoY to INR 20 Cr, indicating potential for geographic expansion. The company also generated INR 8.6 Cr from selling its stake in beauty brand Kimirica, demonstrating portfolio optimisation ahead of its IPO.

Another Stab At The IPO: Just earlier this week, boAt received SEBI approval for its INR 2,000 Cr IPO. Backed by profitability, the company appears better positioned to woo investors this time compared to 2022, when it had to shelve its listing plans.

But, with the wearables market witnessing a decline and the audio business approaching saturation, can the company’s IPO woo public markets? While that is a question for another day, here is boAt’s sound FY25 performance.

From The Editor’s DeskThe Platform Fee Conundrum: Swiggy and Zomato are increasingly using platform fees as a monetisation tool as the broader food delivery sector grapples with flattish growth since the past year. But will it be a sustainable revenue strategy in the long run?

India’s Semiconductor Moment: At the Semicon India 2025, the Centre unveiled its first indigenous space-grade chip and cleared $18 Bn worth of semiconductor projects. But beyond the big headlines, what’s the ground reality?

DevX Files RHP: The coworking space provider has filed its papers with SEBI for its listing, which will solely comprise a fresh issue of 2.35 Cr shares. Its public issue will open on September 10. DevX clocked a profit of INR 1.7 Cr against a top line of INR 158.9 Cr in FY25.

Urban Company All Set For IPO: The hyperlocal services unicorn has set a price band of INR 98 to INR 103 for its upcoming INR 1,900 Cr IPO. At the upper end of the spectrum, Urban Company would be valued at nearly $1.6 Bn.

Ultrahuman Vs Oura: The Delhi HC has dismissed the patent infringement lawsuit filed by the homegrown smart ring maker against the Finnish company. However, Ultrahuman claimed that the HC merely directed it to refile the plea because of a procedural clarification.

$1 Bn Deeptech Fund: Eight India and US-based VC firms have banded together to launch “India Deep Tech Alliance” to invest $1 Bn in homegrown deeptech startups over the next decade. The alliance includes names like Celesta Capital, Accel and Blume Ventures.

TBO Tek To Acquire Classic Vacations: The listed travel tech platform has acquired the US-based company in a $125 Mn deal to expand its operations to North America. Classic Vacations, which offers personalised vacation packages, reported $111 Mn revenue in 2024.

Exotel Cofounder Quits: Ishwar Sridharan has stepped down from the AI-led customer engagement platform after a 14-year-long stint. This comes at a time when the SaaS company has witnessed a slew of top-level exits in the past year.

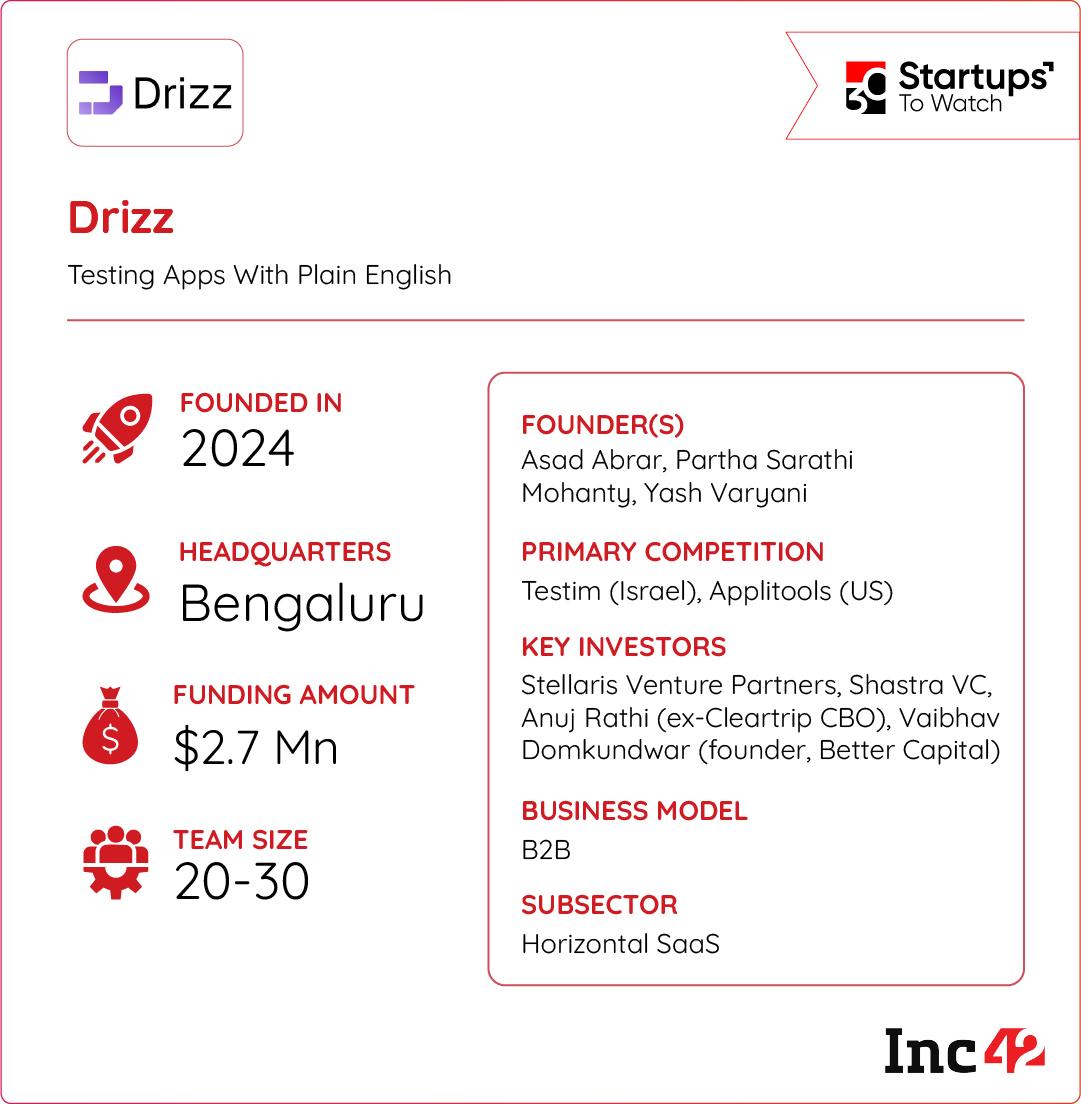

Inc42 Startup Spotlight App Testing Made EasyWith artificial intelligence now generating as much as 40% of new software code, traditional testing methods are proving too slow and labour-intensive. To keep up with the sheer volume and velocity of AI-written code, Drizz has developed a platform that helps quality assurance (QA) teams write, execute, and manage testing using simple and conversational English.

AI Bot For Testing Teams: Instead of writing complex scripts, a QA professional can simply type a command in plain English on Drizz to describe the desired test. The startup’s AI then intelligently interprets the prompt, interacts with the application’s code base as a human tester would, and flags bugs or performance issues in real time, dramatically accelerating the development lifecycle.

A Growing Market: Drizz is vying for market share against players such as Quash, Testsigma, and KiwiQA. The opportunity is massive as all players are eyeing the rapidly expanding Indian mobile app development market, which is projected to become a $756 Bn opportunity by 2027.

Amid this, can Drizz become the go-to tool for QA teams navigating the AI era?

The post boAt In The Black, Rethinking Platform Fees & More appeared first on Inc42 Media.

You may also like

'You'll look like an alien': Senator John Kennedy holds up movie poster to warn against eating recalled shrimp; watch

Telangana, Andhra Pradesh Weather LATEST update: Heavy rainfall alert issued; Check forecast

Axed Australia Batsman Marnus Labuschagne 'Back To Drawing Board' In Ashes Bid

boAt In The Black, Rethinking Platform Fees & More

Vamana Jayanti 2025: Know Date, Rituals, Significance & Auspicious Time