Let’s just agree — creating a super app that does it all isn’t a shiny new concept. In fact, the idea traces its roots back to 2011 when China’s WeChat bundled numerous services into a single mobile platform — messaging, payments, social media, ecommerce, news, ride-hailing, food ordering, and more.

And ever since, India has been on a wild chase for that dream. From fintechs to traditional banks, everyone wants to be everywhere, everything, all at once, with a ubiquitous super app.

While banks fancy calling it the ‘universal bank’ model, bundling credit cards, insurance, loans and investments, fintechs don’t bother with jargon.

However, underneath the super app gloss, it is mostly the basics — payments, lending, mutual funds, and ecommerce. This is exactly what Kunal Shah’s CRED is trying to change. Last week, the company looked to raise the bar, yet again.

Targeting its core base of creditworthy and aspirational individuals, CRED launched an all-in-one asset tracker that pulls together investments in stocks and mutual funds, digital gold and even bank balances under one place. It also launched a co-branded credit card and an exclusive club called Sovereign for HNIs.

From afar, it might seem like CRED is stepping away from the herd, breaking the usual super app mould. But, is it really so? And is it going to be a profitable transition?

Before we dive in, here are the top stories from our newsroom this week:

Has The GPU Killer Arrived? As demand for AI shoots up, TPUs are stepping into the spotlight as a faster, more energy-efficient alternative to GPUs. But with NVIDIA still calling the shots and India’s access limited, can TPUs really change the game for the country’s AI future?

Groww’s Lopsided IPO: Groww’s DRHP throws up a tale of explosive growth. Yet, its issue structure reflects the oft-repeated narrative in new-age company listings, where the OFS component is more than 50-60% of the issue size. Will the heavy VC cashout erode trust?

CityMall’s Three Lefts And A Right: CityMall’s path to INR 1,000 Cr revenue wasn’t straight—it took three pivots from social commerce to groceries, localisation, and private labels. Now thriving in India’s small towns, it faces its toughest test yet: quick commerce.

CRED’s Out-Of-The-Herd MovesThe Kunal Shah-led startup’s intent to stand out from the rest stems from its retention struggle early on in its journey, as its limited offerings weren’t sticky enough to drive engagement. Therefore, it evolved its playbook to attract only the affluent. And now the proposition seems to be evolving into something even sharper.

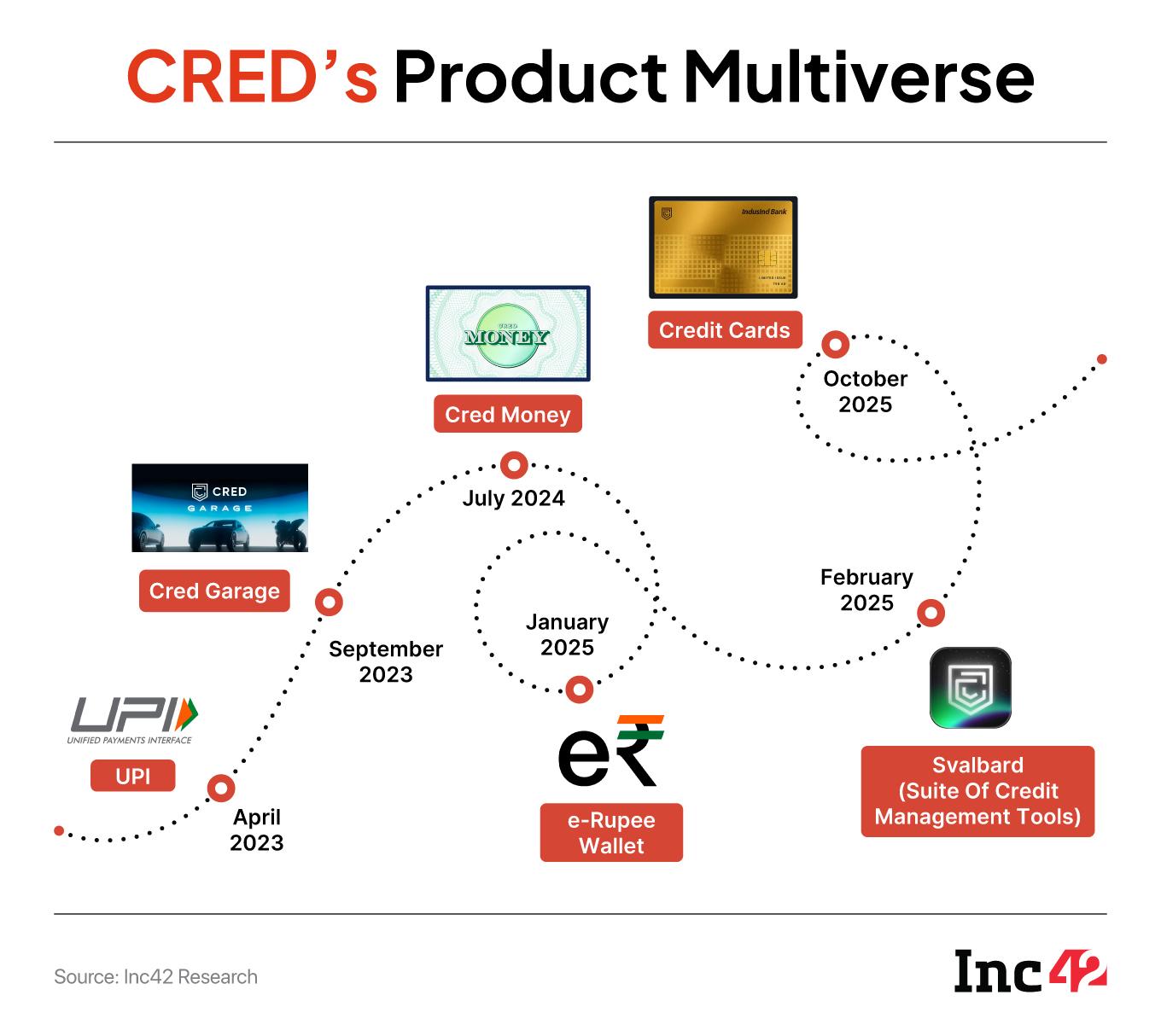

CRED’s Svalbard suite, for example, launched earlier this year, is all about a deeper push into credit management, with products like Cash+ for instant liquidity against mutual funds and a consolidated credit score tracker.

Similarly, CRED Garage goes into vehicle management, insurance, automobile valuation and a member-run marketplace. The company also piloted an e-Rupee wallet in collaboration with the RBI for the Central Bank Digital Currency (CBDC).

“Look closely, and the pattern behind these launches becomes clear. Each new vertical is not only a standalone product but also a brick in a broader ecosystem CRED is building,” said a partner at a venture capital firm focussed on fintech.

This clarity on the premium experience, he said, gives CRED the ability to outshine companies like Paytm, PhonePe, Groww, Flipkart, Jio Financial Services and others that are also investing in user acquisition, building retention, and cross-selling.

Aspirations Take Off, But UPI Is Still KeyWhat makes CRED’s super app strategy different is also the fact that it does not have a stronghold on any one particular vertical. PhonePe dominates UPI, Paytm has the brand recall and scale, while Groww is clearly focussed on investments. But CRED does not have a niche, except its premium positioning.

As one expert we spoke to put it, in its desire to be ubiquitous, CRED is losing its grip on basic offerings, which is not a good sign.

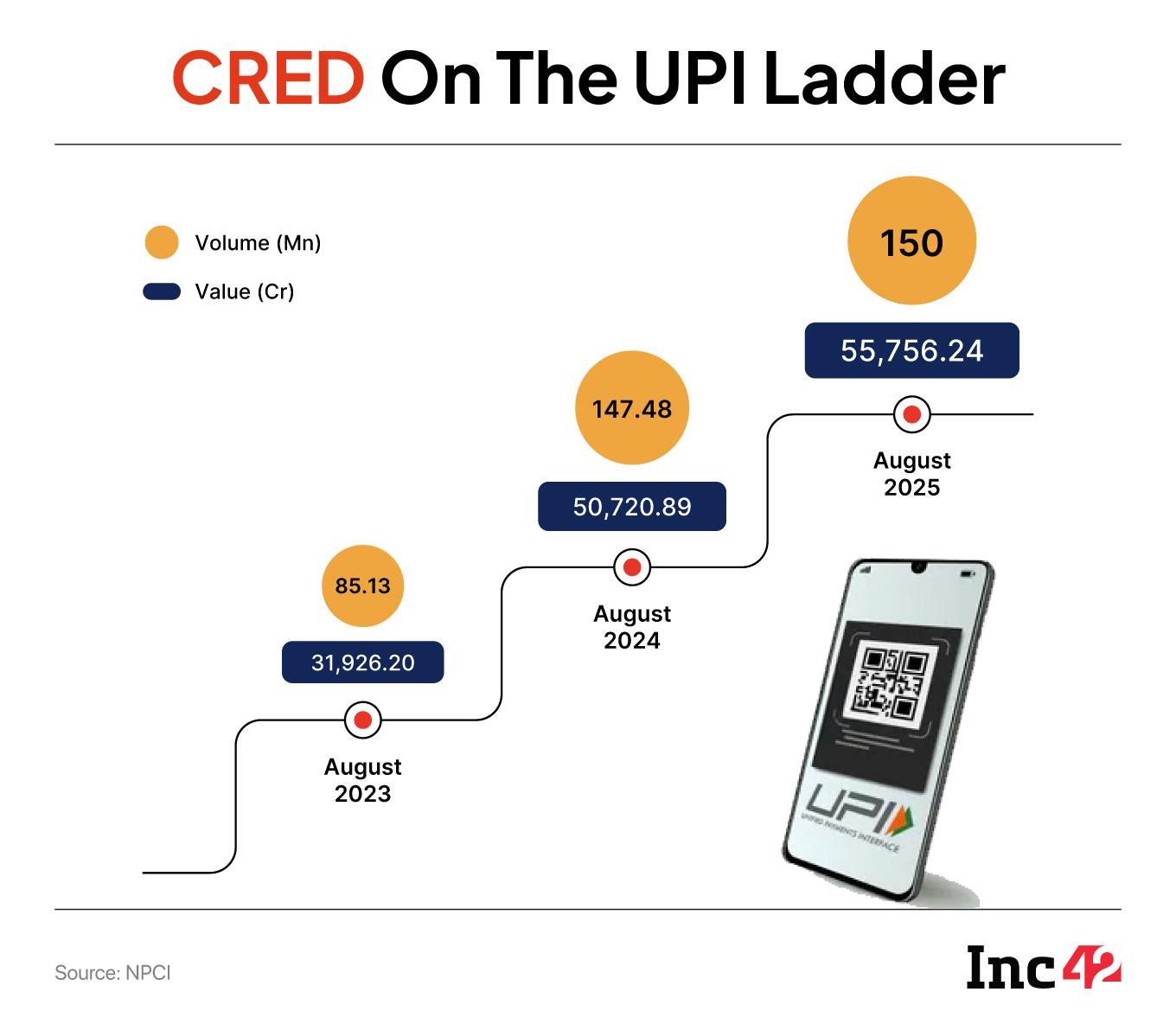

For instance, amid rising aspirations to dress up differently, CRED is losing grip on UPI, a critical part of the super app funnel. CRED launched UPI payments in April 2023 and made it into the top four in June 2024. It remained there until November 2024, when Navi dethroned it. Since then CRED has also been superseded by Flipkart-owned super.money.

While the UPI transaction volume on CRED has remained flat in the last one year, the total value has grown, implying a larger average transaction size. Between August 2024 and August 2025, the monthly number of transactions grew from 147.48 Mn to 150 Mn, up a mere 1.71%. The total value rose by 10% from INR 50,720.89 Cr to INR 55,756.24 Cr.

But as we have explored here, the difference between CRED and the leading UPI apps is significant.

For context, even as CRED’s share remains marginal in the broader context of India’s UPI ecosystem at just 0.75% of transactions, its users account for 2.24% of total transaction value.

Despite its power user play, the competition is intensifying, and newer players are gaining ground — an area of concern for CRED. Plus the aspiration to be different has not translated into profitability.

“There are reasons for this, too. First: they are not category creators… big, established rivals are already out there. Secondly, the top 1-2% users that CRED serves are dispersed, which poses a challenge in generating cash,” Sharat Chandra, founder of consulting firm EmpowerEdge Ventures, said.

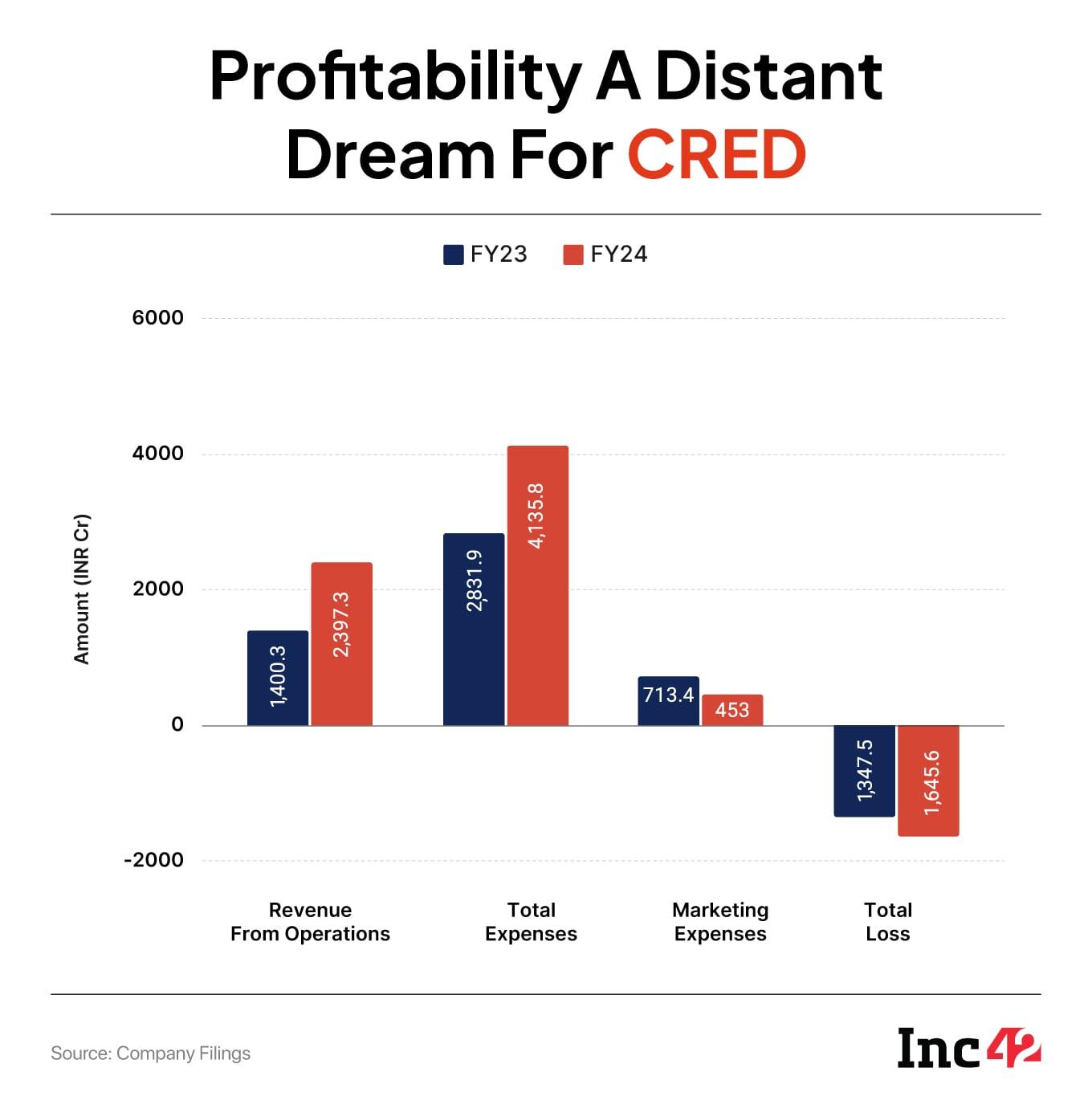

So let’s address the elephant in the — profitability. Even though CRED has been successful in building and milking a glorified userbase of lofty individuals, it was burning cash as if it were its second business until FY24.

Despite garnering INR 2,397.3 Cr in FY24 revenues, its net loss widened 22% YoY to INR 1,645.6 Cr in FY24. CRED has yet to release its FY25 numbers.

“Despite having a good set of users, they are still not profitable. I’m not sure how they want to crack that piece of the puzzle,” said Chandra.

He added that even with offerings aimed at high-value users — CRED Money, Sovereign and Gold Cards, and CRED Garage — most remain strategic or experimental rather than major revenue drivers.

Another key concern is that CRED has often tried to circumvent questions around profitability by describing itself as a young company that will grow into its full potential in the long run. Not everyone is convinced.

“If you don’t focus first on profitability, it will be an elusive dream,” Chandra added.

As elusive a dream as it may look, there is no denying that CRED is sitting on a gold mine of roughly 40 Mn affluent consumers, and if it has the right product levers, this base is enough to change the market overnight. But, for that to happen, CRED will have to play its cards just right.

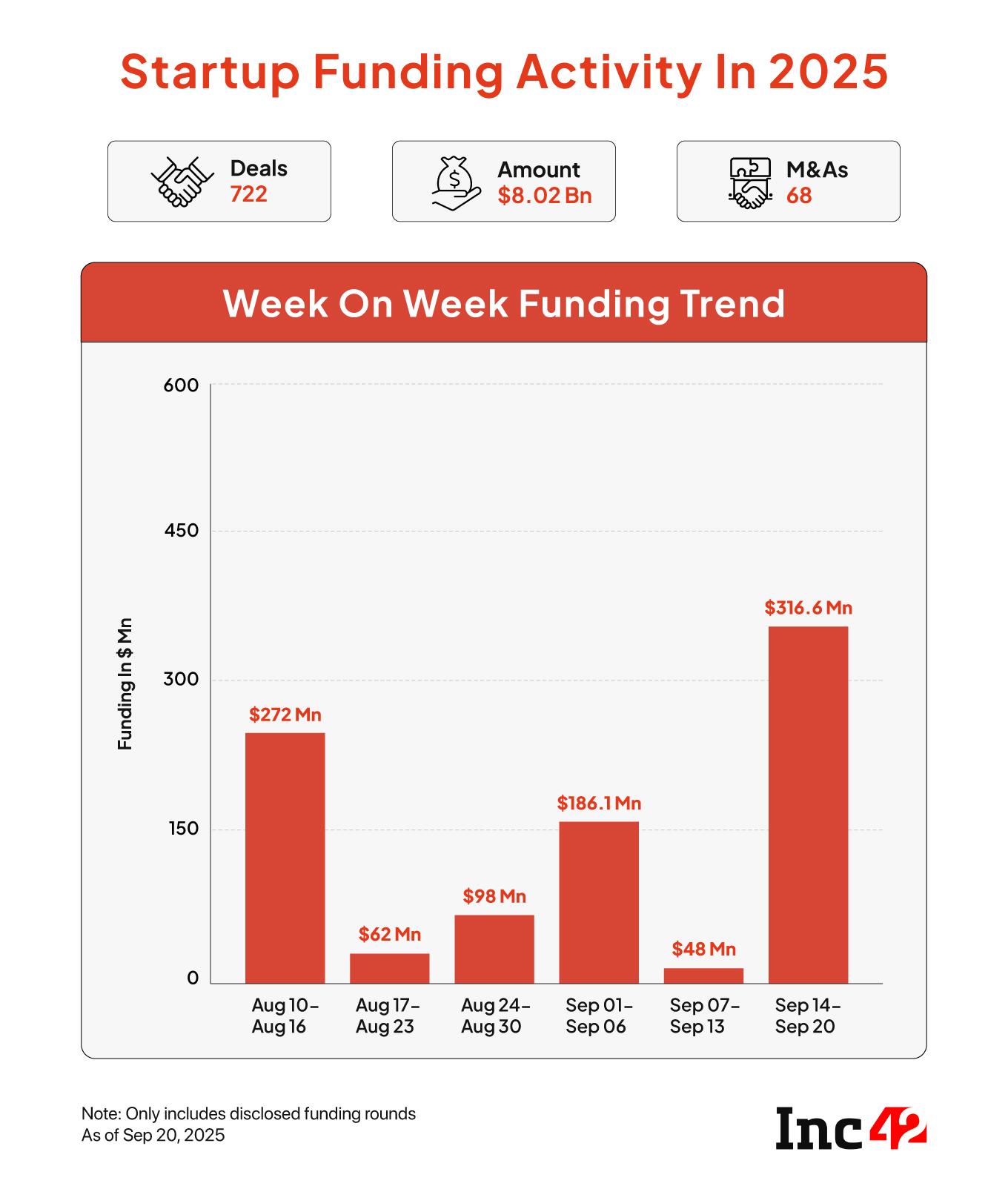

Sunday Roundup: Startup Funding, Deals & MoreA Great Funding Week: Indian startup funding surged past $300 Mn last week, with 23 startups raising a total of $316.6 Mn between September 15 and 20. This marks nearly a sevenfold jump from last week’s $47.8 Mn across 18 deals.

Pepperfry To Get Acquired: BSE-listed TCC Concept is eyeing a full takeover of Pepperfry. While numbers aren’t out yet, the deal aims to mix TCC’s tech know-how with Pepperfry’s marketplace — hopefully turning the latter’s losses into couches of cash.

Churn At Gameskraft: Rattled by the ban on real money gaming, Gameskraft has let go more than 100 employees — just like Games24x7, MPL, and Pokerbaazi. There are expectations of more such layoffs in the short term as gaming startups reprioritise their business needs.

BigBasket’s FY25 Loss Bloats: The quick commerce major’s FY25 results show a worrying trend. Its net loss rose 42% to INR 2,007 Cr, while operating revenue slipped 2% YoY to INR 9,867 Cr. Total expenditure, too, increased to INR 11,893.6 Cr in FY25 from INR 11,515.1 Cr a year ago.

Paytm Brings Back BNPL: Paytm has relaunched its buy-now-pay-later service in partnership with Suryodaya Small Finance Bank. Currently rolling out selectively, the BNPL offering gives users up to 30 days of short-term credit, with wider expansion planned soon.

[Edited by Shishir Parasher]

The post Another Brick In The CRED Wall appeared first on Inc42 Media.

You may also like

Ex Delhi captain Mithun Manhas hits the front foot in race for BCCI Presidency

Hidden Link Between Pregnancy And Oral Health That Every Expectant Mother Should Know

Riddhima Kapoor Sahni Writes About Unlocking Children's Creativity And Fueling Imagination

'Bad things are going to happen': Trump issues ultimatum to Aghanistan over Bagram airbase

Final solar eclipse of 2025 to be observed tonight